Welding Electrode Production Costs: A Raw-Material Perspective

Coated welding electrodes are a profitable, growing market—but profitability depends on understanding all welding electrode production costs. A large portion comes from raw materials: core wire, coating powders, binder (adhesive), and packaging cartons. This article reviews the raw-material cost components for E6013 and E7018 electrodes and provides estimated production costs for both products as of July 2025.

- Raw Materials of E6013 and E7018

- Cost of Raw Materials

- Total Cost of E6013

- Total Cost of E7018

- Conclusion

1.Raw Materials of E6013 and E7018

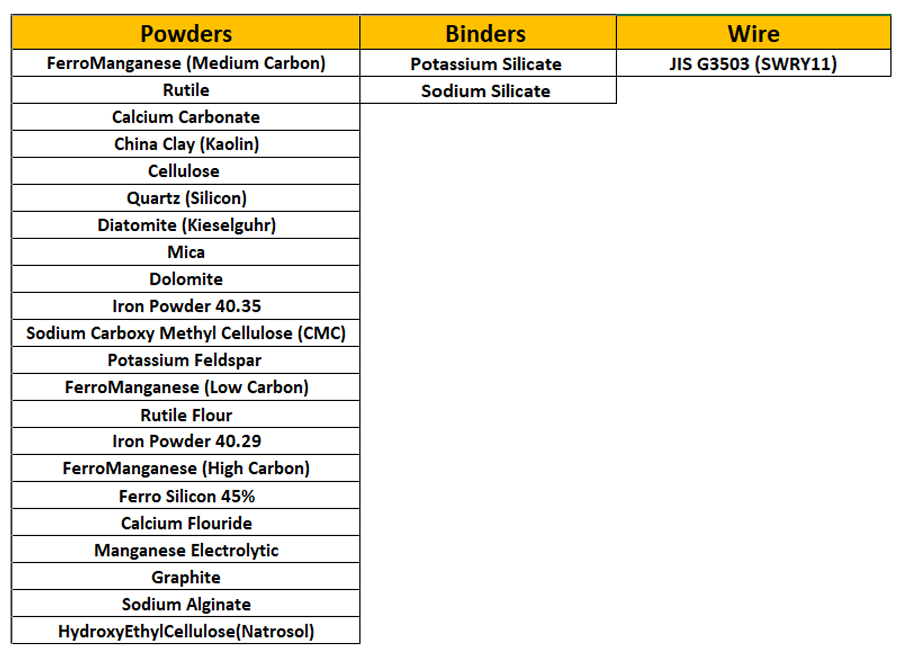

For E6013 and E7018, the raw-material basket is similar but the emphasis is different. E6013 is a rutile-based electrode: the coating centers on rutile/ilmenite, with helpers like calcium carbonate (limestone), kaolin/feldspar, mica, and small de-oxidizers (ferromanganese, ferrosilicon). Some E6013 variants add iron powder for higher deposition. The binder is usually potassium silicate.E7018 is low-hydrogen and more basic: the coating leans on limestone (CaCO₃) and often fluorspar (CaF₂), with iron powder common to boost deposition and meet strength. Here the binder window is tighter—controlled silicate solids/viscosity and very dry powders are critical to keep hydrogen low.

Raw Materials for Production of E6013 and E7018 Welding Electrodes

2.Cost of Raw Materials

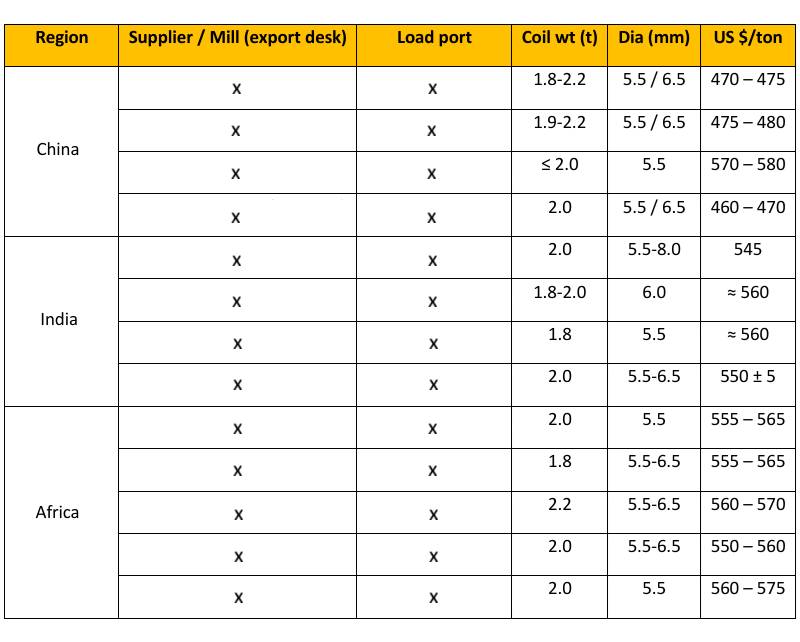

When planning raw-material purchases for coated electrodes, start local and go global only when you must. Build your basket so that most items wire rod, common minerals (e.g., limestone/kaolin), and standard chemicals come from reliable suppliers inside your country. Import only those materials that lack a true domestic equivalent or where quality gaps exist (for example, certain grades of rutile or fluorspar).Your sourcing plan should reflect your factory’s location: a plant in South Africa can source key minerals like Rutile Sand domestically; a plant in Iraq will likely import this powder. To control total cost per kilogram, maintain a current map of qualified suppliers (names, addresses, specs, lead times), calculate landed cost (FOB/CIF + inland freight + duties + banking/terms), and keep at least three approved sources for each critical item. This approach reduces price risk, shortens lead times, and protects production quality for both E6013 (rutile-based) and E7018 (low-hydrogen, iron-powder/basic) electrodes.

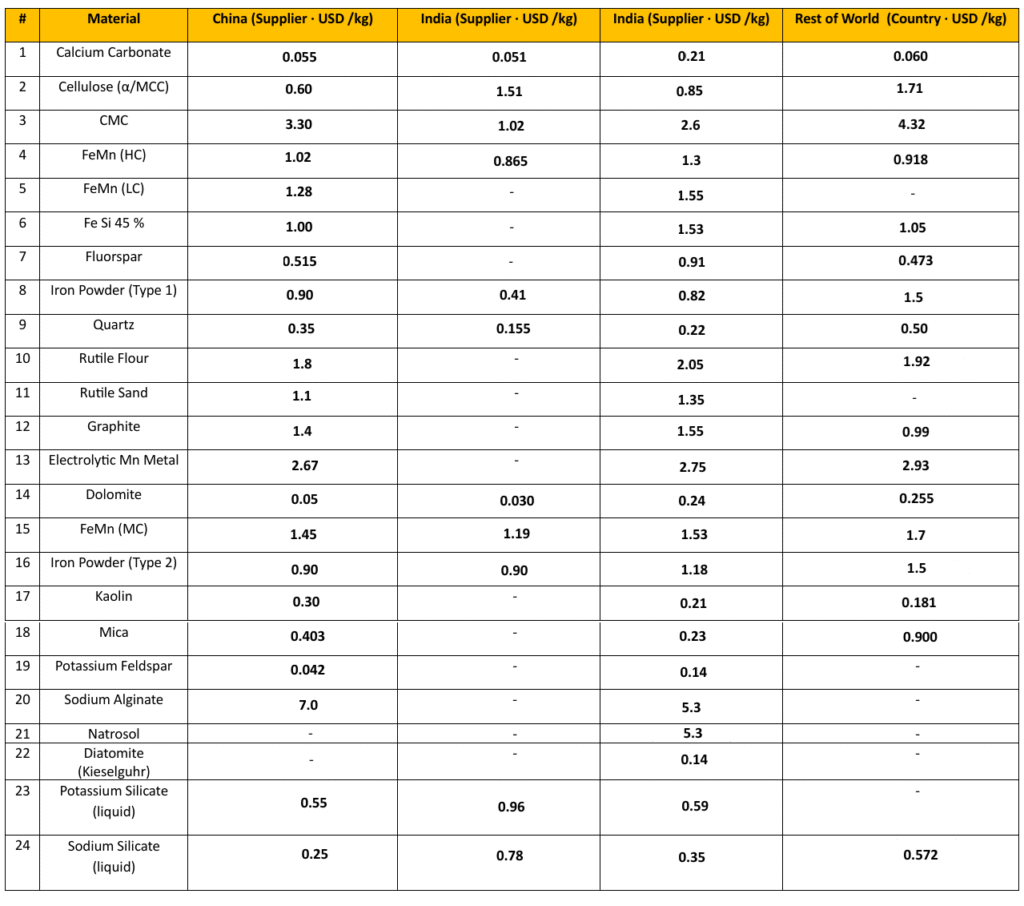

The table below shows the average price of raw materials, including wire, powders, and binders, as of the beginning of July 2025.

SWRY11 Coiled Wire FOB Price (Approx.)

Powders and Binders FOB Price (Approx.)

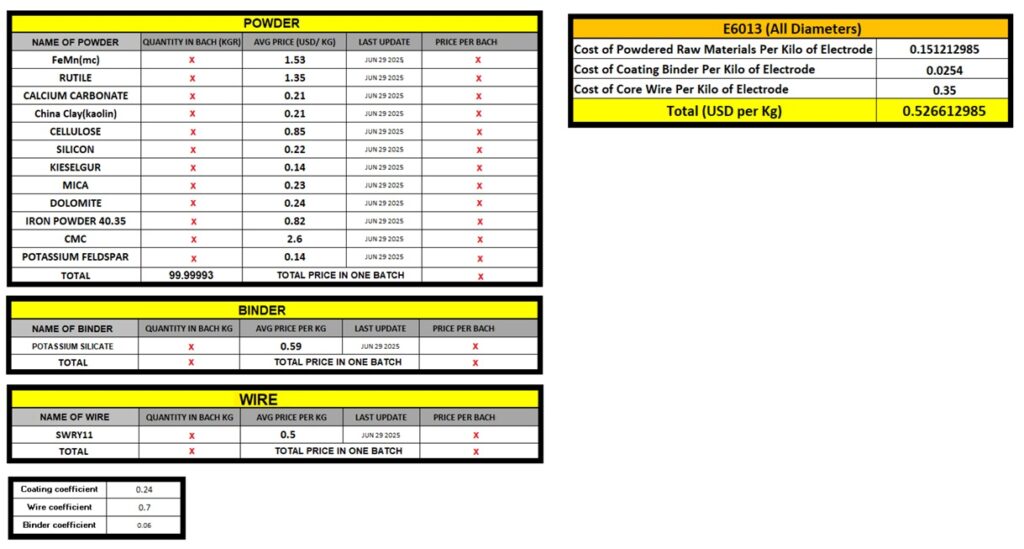

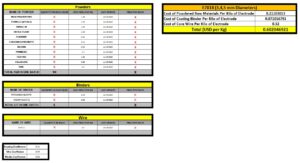

3.Total Cost of E6013

For E6013 electrodes, the cost shares are: 24% coating powders, 6% binder (adhesive), and 70% core wire (total 100%). The powders cost will be calculated based on the specific coating formula used. Using these coefficients, you can compute the separate costs of powders, binders, and wire, then sum them to obtain the final electrode cost.

4.Total Cost of E7018

For E7018 electrodes, the cost shares are: 31% coating powders, 5% binder (Sodium + Potassium Silicate), and 64% core wire (total 100%). Like E6013,The powders cost will be calculated based on the specific coating formula used. Using these coefficients, you can compute the separate costs of powders, binders, and wire, then sum them to obtain the final electrode cost.

5.Conclusion

Raw materials drive electrode economics. For E6013, about 70% of cost sits in the core wire, with 24% in coating powders and 6% in binder; for E7018, the shares shift to 64% wire, 31% powders, and 5% binder. Because formulas and local supply conditions differ, the most reliable way to control unit cost is to (1) source domestically wherever quality allows, (2) keep at least three qualified suppliers for critical powders (e.g., rutile, fluorspar), and (3) calculate true landed cost (FOB/CIF, freight, duties, payment terms).